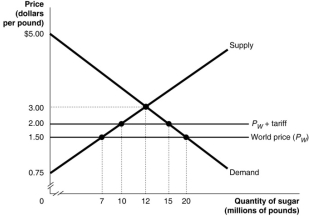

Figure 13.1  Suppose the government imposes a $0.50 per metric tariff on sugar imports.Figure 13-1 shows the demand and supply curves for sugar and the impact of this tariff.

Suppose the government imposes a $0.50 per metric tariff on sugar imports.Figure 13-1 shows the demand and supply curves for sugar and the impact of this tariff.

-Use Figure 13.1 to answer questions a-i.

a.Following the imposition of the tariff, what is the price that domestic consumers must now pay and what is the quantity purchased?

b.Calculate the value of consumer surplus with the tariff in place.

c.What is the quantity supplied by domestic sugar producers with the tariff in place?

d.Calculate the value of producer surplus received by Australian sugar producers with the tariff in place.

e.What is the quantity of sugar imported with the tariff in place?

f.What is the amount of tariff revenue collected by the government?

g.The tariff has reduced consumer surplus.Calculate the loss in consumer surplus due to the tariff.

h.What portion of the consumer surplus loss is redistributed to domestic producers? To the government?

i.Calculate the deadweight loss due to the tariff.

Definitions:

Net Investment

The total amount spent by a company for purchasing new assets, after accounting for depreciation.

Gross Investment

The total amount spent on purchases of new capital and on replacing depreciated capital within an economy.

Net Investment

The sum of money used to purchase new capital assets, subtracting the depreciation from current capital assets.

Depreciation

The reduction in the value of an asset over time, due in particular to wear and tear.

Q13: Ordinarily, governments attempt to promote competition in

Q33: Refer to Figure 14-1. The figure above

Q36: In general, the supply curve for a

Q42: Refer to Figure 14-2. What is the

Q46: The labour supply curve<br>A) shows the relationship

Q72: Refer to Figure 15-10. One way to

Q82: Medical research that ends in a cure

Q103: Refer to Figure 11-2. If the government

Q120: Adverse selection occurs in the market for

Q165: A supplier of paper napkins to the