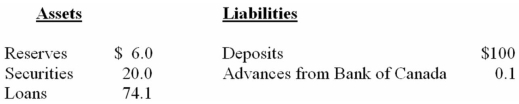

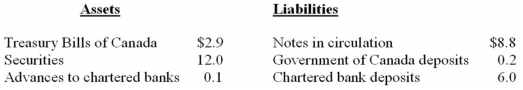

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers;that is,do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.

CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM

BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA

-Refer to the above information.The maximum money-creating potential of the chartered banking system is:

Definitions:

Cash Balance

The amount of cash a company has on hand at any given time, which includes currency, coins, and balances in checking and savings accounts.

Market Rate of Return

The average return that investors expect to earn from a particular investment, based on historical or anticipated performance.

Trading Costs

Trading costs are the expenses incurred in buying and selling financial instruments, including commissions, spreads, and slippage.

Lockbox System

A service provided by banks to companies for the collection of payments from customers, where the payments are sent directly to a post office box to expedite processing.

Q5: The interest rate at which the Bank

Q15: If the desired reserve ratio falls:<br>A) banks

Q30: A consumer holds money to meet spending

Q98: A major goal of the World Trade

Q99: Refer to the above diagram where D

Q114: In which case would the quantity of

Q170: Refer to the above data.If a lump-sum

Q175: Refer to the above tables.If these two

Q185: Refer to the above graph,in which D<sub>t</sub>

Q204: An expansionary monetary policy may be frustrated