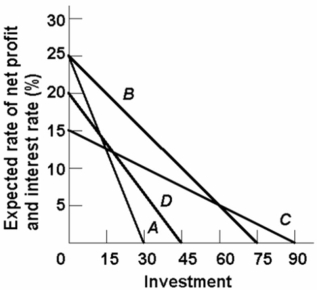

Assume that for the entire business sector of a private closed economy there is $0 worth of investment projects which will yield an expected rate of return of 25 percent or more.But there are $15 worth of investments which will yield an expected rate of return of 20-25 percent;another $15 with an expected rate of return of 15-20 percent;and similarly an additional $15 of investment projects in each successive rate of return range down to and including the 0-5 percent range.

Which of the lines on the above diagram represents these data?

Definitions:

Perfectly Elastic

A situation in market economics where the quantity demanded or supplied of a good changes infinitely in response to any change in price.

Market Interest Rates

The prevailing rates at which borrowers can obtain loans and lenders can offer loans in the financial market, depending on supply and demand dynamics.

Inverted-U Theory

A theory suggesting that there is an optimal level of certain factors (such as stress or creativity) beyond which performance or efficiency begins to decline.

Concentration Ratios

A measure of the market share controlled by a certain number of the largest companies in an industry, indicating the level of market concentration.

Q1: In deriving the aggregate demand curve from

Q6: Consider a bond which pays 7% semi-annually

Q15: Refer to the above diagram.Assume that nominal

Q22: The average propensity to consume can be

Q113: The multiplier effect indicates that:<br>A) a decline

Q134: Refer to the above data.The equilibrium price

Q135: If the real interest rate in the

Q153: Refer to the above information.If the real

Q157: In equilibrium in the above private open

Q158: Exports have the same macroeconomic effect on