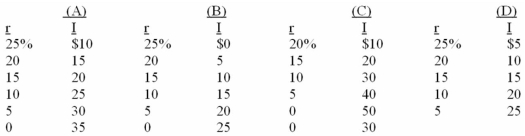

Assume there are no prospective investment projects (I) which will yield an expected rate of return (r) of 25 percent or more,but that there are $5 billion of investment opportunities with an expected rate of return between 20 and 25 percent,an additional $5 billion between 15 and 20 percent,and so on.The investment-demand curve for this economy is:

Definitions:

Exponential Smoothing

A time series forecasting method for univariate data that applies exponentially decreasing weights over past observations.

Weight

In statistical contexts, weight refers to a coefficient assigned to data points or parameters indicating their importance or relevance in the analysis.

Liquor Sales

The total volume or amount of alcoholic beverages sold within a given timeframe, often analyzed for economic or regulatory purposes.

Moving Averages

A statistical procedure used to analyze time series data by creating a series of averages of different subsets of the full data set.

Q28: Collective bargaining agreements that prohibit wage cuts

Q32: The basic difference between consumer goods and

Q36: Which of the following relations is not

Q45: If S = -60 + .25Y and

Q93: Refer to the above data.If the price

Q97: Refer to the above diagram.If the full-employment

Q109: Marginal analysis means that decision-makers compare the

Q109: Unplanned changes in inventories:<br>A) cause the economy

Q160: Which of the following will not cause

Q202: Refer to the diagram below.The equilibrium condition