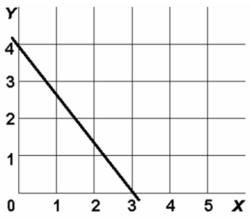

-In the above diagram variables x and y are:

Definitions:

Excess Amortizations

Amortization expenses that are higher than what is considered normal or expected, often due to aggressive repayment of debt or intangible assets.

Intra-Entity Asset Transfers

Operations that include moving assets from one department to another within the same organization.

Consolidation Purposes

The process of combining financial statements from different subsidiaries or entities within an organization to present as one entity for financial reporting.

Amortization

The process of spreading out a loan into a series of fixed payments over time, decreasing the balance through payments towards the loan's principal and interest.

Q5: The bottom-up approach to computing the operating

Q10: For all levels of income to the

Q11: You have been asked to evaluate 2

Q16: Assume the consumption schedule for a private

Q25: The global financial crisis that spread to

Q28: Synergy occurs when the:<br>A) added value is

Q110: In drawing the production possibilities curve we

Q132: If the MPC is .6,the simple multiplier

Q171: If the MPC is .8 and the

Q196: A "recessionary expenditure gap" is:<br>A) the amount