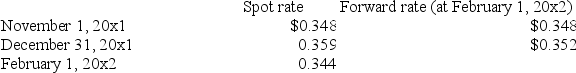

On November 1, 2001 Zamfir Company, a U.S. corporation, purchased minerals from a Russian company for 2,000,000 rubles, payable in 3 months. The relevant exchange rates between the U.S. and Russian currencies are given:  The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

Assume that on November 1, 2001 Zamfir Company enters a forward contract to buy 2,000,000 rubles on February 1, 2002. What is the fair value of the forward contract on December 31, 2001?

Definitions:

Q3: Define what is meant by a positive

Q8: What is the primary difference between transaction

Q15: What is utility and what is its

Q26: Schlamp & Co. is considering building a

Q35: In a recent survey, what issue did

Q37: A production possibilities table for two products,grain

Q51: What is "Subpart F" income?<br>A) All foreign

Q87: Longview Golf Company sells a special putter

Q97: Unused capacity is considered wasted resources and

Q122: Normal capacity utilization is not the same