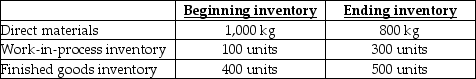

Use the information below to answer the following question(s) .Daniel Inc.expects to sell 6,000 ceramic vases for $20 each in 2018.Direct materials costs are $2, direct manufacturing labour is $10, and manufacturing overhead is $3 per vase.Each vase requires 0.5 kilograms (kg) of material which is all added at the start of production.The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs; the units in beginning inventory are completed before new units are started.Each vase requires one hour of direct labour, and manufacturing overhead is allocated based on direct labour hours.The following inventory levels are expected to apply to 2018:

-On the 2018 budgeted income statement, what amount will be reported for cost of goods sold?

Definitions:

Selling Price

The amount of money for which a product or service is sold to customers.

Raw Materials

The basic materials from which products are made, typically unprocessed or minimally processed before being used in manufacturing processes.

Contribution Margin

The difference between sales revenue and variable costs, indicating how much revenue contributes to covering fixed costs.

Fixed Costs

Expenses that do not change in total regardless of the level of production or sales activity, such as rent, salaries, and insurance.

Q7: What is the absorption costing break-even point

Q24: You are the management accountant for the

Q34: Vienna Chocolate Company produces fudge in large

Q76: There is causal relationship between the variable

Q95: What is the break-even point in cases?<br>A)6

Q103: What is the total manufacturing cost of

Q108: A favourable production-volume variance indicates that the

Q146: Cost assignment includes cost allocation for indirect

Q157: Which of the following would be appropriately

Q164: What is the amount budgeted for cost