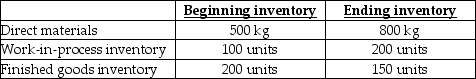

Use the information below to answer the following question(s) .Samson Inc.expects to sell 10,000 barbells for $18.00 each.Direct materials costs are $5.00, direct manufacturing labour is $6.00, and manufacturing overhead is $2.50 per barbell.Each barbell requires 6 kilograms (kg) of material which is all added at the start of production.The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs; the units in beginning inventory are completed before new units are started..Each barbell requires one-quarter hour of direct labour, and manufacturing overhead is allocated based on direct labour hours.Marketing costs are $2.00 per barbell.The following inventory levels are expected to apply to 2019:

-On the 2019 budgeted income statement, what amount will be reported for gross margin?

Definitions:

Fixed Costs

Costs including rent, salaries, and insurance that stay the same regardless of production or sales amounts.

Variable Costs

Costs that fluctuate with the level of production or sales volume, such as materials and labor.

Fixed Costs

Expenses that do not change in total regardless of changes in the volume of goods or services produced or sold.

Operating Income

The profit realized from a business's ongoing operations, calculated before taxes and interest payments are deducted.

Q27: Product-cost cross-subsidization means that if a company

Q35: The master budget embraces the impact of<br>A)operating

Q57: Stretch goals in budgeting tend to<br>A)decrease line-management

Q62: Randy's Production Company uses a single cost

Q71: Break-even point in units is<br>A)2,000 units.<br>B)3,000 units.<br>C)5,000

Q117: What is the cost driver rate if

Q123: A leased factory building has a fixed

Q123: Cost-volume-profit analysis is useful for<br>A)helping managers to

Q127: Benchmarking key activities can be even more

Q137: Explain two concerns when interpreting the production-volume