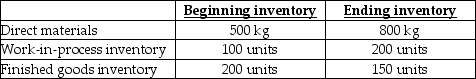

Use the information below to answer the following question(s) .Samson Inc.expects to sell 10,000 barbells for $18.00 each.Direct materials costs are $5.00, direct manufacturing labour is $6.00, and manufacturing overhead is $2.50 per barbell.Each barbell requires 6 kilograms (kg) of material which is all added at the start of production.The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs; the units in beginning inventory are completed before new units are started..Each barbell requires one-quarter hour of direct labour, and manufacturing overhead is allocated based on direct labour hours.Marketing costs are $2.00 per barbell.The following inventory levels are expected to apply to 2019:

-How many kilograms of material will need to be purchased for 2019 production and inventory requirements?

Definitions:

Bad Debt Expense

An estimated expense recognized by businesses for accounts receivable that are considered unlikely to be collected.

Salvage Value

The projected value of an asset when it reaches the end of its operational lifespan.

Useful Life

The estimated time period an asset is expected to be used by a company before it is no longer useful or becomes obsolete.

Double-Entry System

An accounting system where each transaction is entered twice, as a debit in one account and a credit in another, to ensure the accounting equation is always balanced.

Q8: The direct manufacturing labour rate variance is

Q27: Budgets that change (rolling or continuous)motivate managers

Q34: John wants to identify the total cost

Q50: Simple cost systems distort product costs because<br>A)they

Q58: Gerdie Company has the following information:<br> <img

Q59: The first step in job costing is

Q60: Discuss the importance of the sales forecast

Q73: Asian Tools, a manufacturer of precision hand

Q108: Camden Company gathered the following information for

Q147: Total revenues less total fixed costs equal