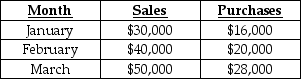

Answer the following question(s) using the information below.The following information pertains to Tiffany Company:

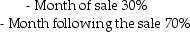

Cash is collected from customers in the following manner:

Cash is collected from customers in the following manner:

40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.Labour costs are 20% of sales.Other operating costs are $15,000 per month (including $4,000 of depreciation) .Both of these are paid in the month incurred.The cash balance on March 1 is $4,000.A minimum cash balance of $3,000 is required at the end of the month.Money can be borrowed in multiples of $1,000.

40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.Labour costs are 20% of sales.Other operating costs are $15,000 per month (including $4,000 of depreciation) .Both of these are paid in the month incurred.The cash balance on March 1 is $4,000.A minimum cash balance of $3,000 is required at the end of the month.Money can be borrowed in multiples of $1,000.

-How much cash will be paid to suppliers in March?

Definitions:

False-Negative

A test result that incorrectly indicates no presence of a condition, such as a disease or a specific finding, when it is actually present.

Second Trimester

The period in pregnancy that extends from the 13th to the end of the 26th week, characterized by rapid growth of the fetus and further development of fetal organs.

Embryo

A group of cells, called the inner cell mass, that develops from the blastocyst during the embryonic prenatal period to become the fetus.

Fetus

A developing human from roughly eight weeks after conception until birth.

Q34: The cash budget helps avoid unnecessary idle

Q46: JamJee Enterprises uses a job costing system.Record

Q47: How much cash will be disbursed in

Q72: The textbook discusses five levels of variances:

Q89: How does direct cost tracing improve cost

Q109: Compute the total standard cost per book

Q130: Direct cost tracing will accomplish which of

Q168: What is the direct material mix variance

Q181: If a purchasing agent is able to

Q187: The input standard cost per completed unit