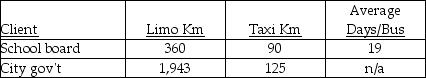

Use the information below to answer the following question(s) .A transportation company provides bussing, limo and taxi service.The company charges: $350 per day for bussing service; $2.00 per kilometre for taxi service; and, $3.50 per kilometre for limo service.Two individual clients, the school board and the city government offices use the majority of the limo service on a contract agreement.Bussing services are used exclusively by the school board, and the taxi service is used almost exclusively by the general public, although the school board uses the taxi services when individual students have to be transported on occasion.Indirect costs are accumulated on internal records at $1.50 per kilometre for limo use and $1.00 per kilometre for taxi use, and $195 per day for each of the twenty buses.The company's costing system has tracked the following activities for the month:

-The previous controller at the transportation company had always estimated the indirect costs at 25% of billings.What indirect costs were accumulated for each major client for the month under this assumption?

Definitions:

Mandated Reporters

Individuals required by law to report suspected cases of abuse or neglect to designated authorities.

State Laws

Laws that are established and enforced by the government of a specific state, as opposed to federal laws, which govern the country as a whole.

Duty To Warn

Duty to warn is a legal concept that obligates individuals, such as healthcare providers or therapists, to inform others if a specific individual poses a danger to themselves or others.

Autonomous Agent

An individual who acts independently, making choices and decisions based on their own free will and understanding.

Q11: What are the 2019 budgeted costs for

Q22: Managers generally have more control over efficiency

Q25: Operating income is equal to net income

Q47: Mediquip International is a manufacturing firm that

Q77: Cost pools are defined as groupings of

Q100: If the sales mix shifts to four

Q126: What is the direct materials mix variance

Q127: Which two ratios are used in the

Q132: Fixed and variable costs may be allocated

Q155: What are three possible ways to dispose