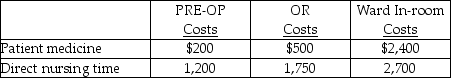

Use the information below to answer the following question(s) .A Hospital uses a job cost system for all surgery patients.In February, the pre-operating room (PRE-OP) and operating room (OR) had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively.The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month.PRE-OP, OR and the hospital ward have separate indirect cost pools.The hospital uses a budgeted overhead rate for applying overhead to patient stays.For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms.He was in the hospital for 5 days (120 hours) .Other costs related to Jones were:

-What was the total PRE-OP cost for patient Jones?

Definitions:

FICA Tax

A U.S. federal payroll (or employment) tax imposed on both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, disabled people, and children of deceased workers.

Federal Income Tax

A tax levied by the government on the annual income of individuals, corporations, trusts, and other legal entities.

Net Pay

The amount of an employee's earnings after all deductions, including taxes and retirement contributions, have been subtracted.

FICA Tax

A United States federal payroll tax that funds Social Security and Medicare, deducted from employees’ paychecks and matched by employers.

Q6: The direct materials mix variance is the

Q42: What is the Production Division's operating income

Q62: What are Wheels's and Assembly's residual incomes

Q71: Break-even point in units is<br>A)2,000 units.<br>B)3,000 units.<br>C)5,000

Q97: An expected value decision model is used

Q104: What would his break-even point be assuming

Q154: The following data for the Telephone Company

Q155: How are cost drivers selected in activity-based

Q158: The Auto Division of Fran Corporation has

Q163: An interactive control system is a formal