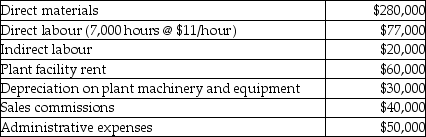

Answer the following question(s) using the information below.Sunny Company manufactures pipes and applies manufacturing overhead costs to production at a budgeted indirect cost allocation rate of $15 per direct labour hour.The following data are obtained from the accounting records for June in the current year:

-The actual amount of manufacturing overhead costs incurred in June totals

Definitions:

Pre-tax Income

The income earned by a business before taxes are deducted.

Split-off Point

The stage in a production process where multiple products emerge from a single input, each taking a separate path in the production process thereafter.

Joint Products

Products that are produced simultaneously during the same manufacturing process and from the same raw materials, often with varying values.

Manufacturing Capacity

The maximum amount of products a manufacturing entity can produce over a certain period of time.

Q4: Which of the following is NOT a

Q6: The Mill Flow Company has two divisions.The

Q7: What is the total cost assigned to

Q17: Hill Manufacturing uses departmental cost driver rates

Q22: Capital intensive companies have less risk because

Q26: What is the ending balance of accounts

Q38: The Franscioso Company break-even in sales dollars

Q70: In cost-volume-profit analysis (CVP)it is assumed that

Q100: If the sales mix shifts to four

Q117: What is the cost driver rate if