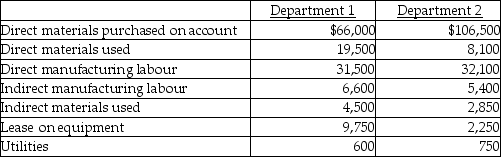

Use the information below to answer the following question(s) .Jim's Computer Products manufactures keyboards for computers.In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2.The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively.For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

-What is the budgeted indirect cost allocation rate for Department 1?

Definitions:

Lessee

A person or entity that leases property or equipment from another, known as the lessor, under a lease agreement.

Lessor

An entity or individual that owns an asset and grants another party the right to use that asset in exchange for periodic rental payments.

Capital Lease

A lease classified by the lessee as an asset and liability on the balance sheet because it effectively transfers substantially all risks and rewards of ownership to the lessee.

Executory Costs

These are costs associated with fulfilling the terms of a contract, excluding the direct material and direct labor costs, such as utilities, insurance, and property taxes involved in leasing.

Q41: Direct material rate variance

Q47: Direct costs are traced the same way

Q52: What is the direct materials yield variance

Q64: Goal congruence occurs when managers act in

Q74: What is the purpose of subsidiary ledgers?

Q78: If the division manager's bonus depends on

Q88: Which of the following statements is TRUE

Q101: Which of the following statements is TRUE

Q105: What is the total manufacturing cost of

Q166: Discuss the possible problems a corporation might