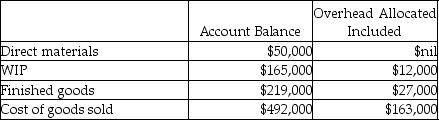

Use the information below to answer the following question(s) .Because the Beckworth Company used a budgeted indirect cost allocation rate for its manufacturing operations, the amount allocated ($190,000) was different from the actual amount incurred ($175,000) .These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.Before disposition of under/overallocated overhead, the following information was available:

-What is the journal entry Beckworth Company should use to write-off the difference between allocated and actual overhead using the proration approach based on overhead allocated?

Definitions:

Sellers

Individuals or businesses that provide goods or services to consumers in exchange for payment.

Tax

A compulsory financial charge or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund public expenditures.

Corporations' Profits

The financial earnings that remain for a corporation after all expenses, taxes, and costs have been deducted from total revenue.

Taxes

Mandatory financial charges or levies imposed by a government on its citizens and businesses as a source of revenue for the government, used to fund public services and goods.

Q5: Nittany Company sells three products with the

Q7: Brilliant Accents Company manufactures and sells three

Q12: The Dougherty Furniture Company manufactures tables.In March,

Q37: Actual costing allocates indirect costs based on

Q49: Arthur's Plumbing reported the following:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3086/.jpg"

Q69: List four ways that activity-based management can

Q70: What is the ROI using current cost?<br>A)28%<br>B)32%<br>C)38%<br>D)35%<br>E)23%

Q77: Cost pools are defined as groupings of

Q158: The Auto Division of Fran Corporation has

Q174: Centralia Components Ltd.manufactures cable assemblies used in