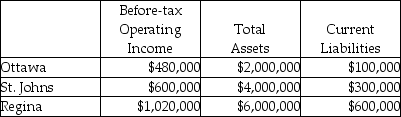

Use the information below to answer the following question(s) .Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million) .The cost of equity capital is 5 percent, while the tax rate is 30 percent.Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for Ottawa?

Definitions:

Consumer Surplus

The discrepancy between what consumers are ready and capable of paying for a product or service and the actual amount they end up paying.

Price Falls

A decrease in the market price of goods or services, often due to increased supply, reduced demand, or other market dynamics.

Existing Buyers

Consumers or businesses that have previously purchased goods or services from a company.

Line Segment

A portion of a line that is defined by two endpoints.

Q30: The only criticism of team-based compensation is

Q31: Job-cost records for Boucher Company contained the

Q60: Cost tracing assigns indirect costs to the

Q96: What is the internal rate of return

Q104: Examples of market-based transfer prices include variable

Q117: What is the payback period for the

Q128: Many new capital projects are investments in

Q129: At the break-even point of 200 units,

Q133: Briefly describe the conditions that should be

Q137: A control system that attempts to focus