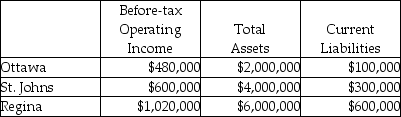

Use the information below to answer the following question(s) .Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million) .The cost of equity capital is 5 percent, while the tax rate is 30 percent.Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for St.Johns?

Definitions:

Q16: Opportunity costs represent the cash flows directly

Q28: Which of the following includes both traced

Q37: Actual costing allocates indirect costs based on

Q87: The plant supervisor's salary is a direct

Q93: Using gross book value as an investment

Q123: ABC systems seek a cost-allocation base that

Q130: The following table presents information related to

Q140: Resources sacrificed on activities undertaken to support

Q151: In an activity-cost pool<br>A)a measure of the

Q161: Most Canadian and U.S.companies use the Sarbanes-Oxley