Answer the following question(s) using the information below:

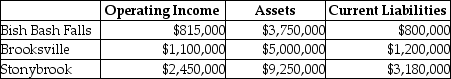

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million) .Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities.The cost of equity capital is 15%, while the tax rate is 30%.

-What is the  for Brooksville?

for Brooksville?

Definitions:

Cash

Cash is a medium of exchange in the form of physical currency, such as coins and banknotes.

Target Shareholders

Individuals or entities that own shares in a company that is the subject of a merger or acquisition proposal.

Self-Tender Offer

A takeover-resistance strategy in which a target corporation offers to buy its shareholders’ stock.

Leveraged Buyout

The acquisition of another company using a significant amount of borrowed money to meet the cost of acquisition.

Q2: Describe job-costing and process-costing systems.Explain when it

Q2: The costs of hiring building security would

Q17: Which of the following is TRUE concerning

Q25: Operating income is equal to net income

Q62: Using activity-based costing to allocate overhead costs,

Q85: For June, manufacturing overhead was<br>A)overallocated by $5,000.<br>B)underallocated

Q88: Which of the following statements is TRUE

Q94: The Transportation Division of Petrolia Paint Company

Q149: Changes in product quality could be considered

Q175: Identify capital expenditures relevant to accomplishing strategic