Answer the following question(s) using the information below:

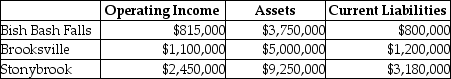

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million) .Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities.The cost of equity capital is 15%, while the tax rate is 30%.

-Novella Ltd.reported a return on investment of 16%, an asset turnover of 6, and income of $190,000.On the basis of this information, the company's invested capital was

Definitions:

Total Tax

Total tax refers to the combined amount of all taxes owed by an individual or business entity in a given tax period, including federal, state, and local taxes.

Provincial Tax Brackets

Various income ranges within a province that are taxed at different rates, used to determine the amount of provincial income tax individuals owe.

Market Value

The current market price for buying or selling an asset or service openly.

Equipment

Tangible property used in operations, such as machinery and hardware, that contribute to the production or service of a business.

Q9: What is Economic Value Added ( <img

Q16: The contribution income statement highlights<br>A)gross margin.<br>B)products costs

Q39: Provide examples of three companies that would

Q49: A(n)_ is a binding agreement between a

Q103: River Road Paint Company has two divisions.The

Q108: What is Bon Accord's operating income per

Q129: Bottle Company operates many bottling plants around

Q132: In determining whether to keep a machine

Q139: A local attorney employs ten full-time professionals.The

Q152: A Canadian company has subsidiaries in France,