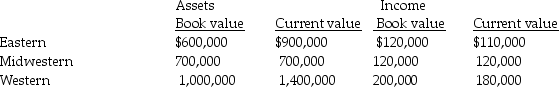

National Can Company has three divisions, Eastern, Midwestern, and Western.Because of very different accounting methods and inflation rates in different countries it is considering multiple evaluation measures.Information gathered about the divisions for the year just ended follows:

The company is currently using a required rate of return of 15 percent.Required:

The company is currently using a required rate of return of 15 percent.Required:

a.Compute the ROI using both book value and current value for all divisions.Round to three decimal places.

b.Compute residual income using book value and current value for all divisions.

c.Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

Definitions:

Anticipatory Breach

Occurs when one party to a contract indicates, either through their actions or words, that they will not fulfill their contractual obligations, allowing the other party to seek remedies before the breach actually occurs.

Performance Date

The specified day by which a contractual agreement, task, or duty must be completed.

Liquidated Damages Clause

A contract provision that specifies a predetermined amount of money one party will pay to the other if they breach certain clauses of the contract.

Mitigate Loss

Actions taken to reduce the severity, seriousness, or painfulness of something, particularly in the context of financial losses.

Q35: Norwegian Furniture Manufacturing makes two models of

Q73: Rent for the building that contains the

Q76: Management control systems collect which type of

Q88: Fabian Company is considering the purchase of

Q127: The key to applying CVP analysis in

Q137: A control system that attempts to focus

Q143: Place the following steps in the order

Q147: A company has total assets of $500,000,

Q162: Factors affecting direct/indirect cost classification include all

Q184: Delivery charges are typically considered to be