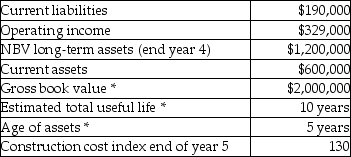

The following data are available for a manufacturing business started as a new company five years ago when the construction cost index was 115:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"

Required:

Calculate the return on investment and the residual income for year five based on current cost.The company's required rate of return is 12%.

Definitions:

DSO Analysis

Stands for Days Sales Outstanding, a calculation used to assess the average number of days it takes a company to collect payment after a sale has been made.

Seasonal Changes

Variations in business or economic activity that occur within specific seasons or periods of the year, often predictable and recurring.

Working Capital Management

The management of a company's short-term assets and liabilities to ensure it has adequate funds to continue its operations and avoid financial distress.

Current Assets

Current assets are assets that a company expects to convert into cash, sell, or consume within one year or within its operating cycle, whichever is longer.

Q8: Keeping all other factors constant, which of

Q22: Last year Reynolds Ltd.reported the following results:<br>

Q27: What would be the new budgeted direct

Q41: What is the Tiller Division's investment turnover?<br>A).50<br>B)1.333<br>C)1.2<br>D)1.5<br>E).833

Q72: A factor used to systematically link an

Q74: If manufacturing overhead costs are considered one

Q76: What is the margin of safety assuming

Q79: A company employs 25 full-time staff.The company

Q167: A benefit of using a market-based transfer

Q180: Costing systems that identify the cost of