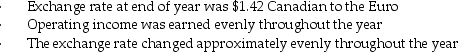

A multinational corporation established a division in Ireland as a subsidiary corporation, with an initial investment in total assets of 13 million €'s, which cost the company $19,240,000 Canadian at the time.The company sent an experienced manager to run the division, and gave her a target of 12% required rate of return, promising a bonus if this was met and/or exceeded.After one year, the subsidiary manager was pleased to report a 15% ROI.You have been able to determine the following data pertaining to the subsidiary:

Required:

Required:

a.Calculate the subsidiary's income in €'s.

b.Calculate the subsidiary's return on investment in Canadian dollars.

c.Calculate the subsidiary's residual income in Canadian dollars.

Definitions:

Monocyte

A type of white blood cell that is part of the immune response, involved in the removal of pathogens and dead or damaged cells from the blood.

Mono-

A prefix meaning single or one, used in various scientific and medical terminologies.

Thrombin

A blood plasma enzyme that initiates blood clotting by transforming fibrinogen into fibrin.

Thromboplastin

A plasma protein that catalyzes the conversion of prothrombin to thrombin, playing a crucial role in the blood clotting process.

Q7: Holmes Electronics Ltd.has three divisions: Resistors, Semiconductors

Q14: A capital proposal is projected to result

Q42: In the graph method of CVP analysis,

Q81: What are the respective residual incomes for

Q89: If the net present value analyses of

Q98: The Tea Division of Canadian Products is

Q104: What is the payback period for the

Q121: Frankenreid Corporation uses a job costing system.Record

Q124: What is the budgeted overhead rate for

Q147: Cost tracing is<br>A)the assignment of direct costs