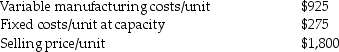

Alpine Ltd.has two divisions.Division A manufactures components that can be sold in the external market place or transferred to Division B for further processing.The following data relate to Division A's component product.  The capacity of the plant is 2,500 units per year.Division B has offered to purchase 350 units from Division A at a price of $1,600/unit, which is the market price of the component.The manager of Division A has refused this offer stating that it would only return a rate of 25.00%, when the divisional target return on sales is 28.00%.The Division A manager also states that additional fixed costs of $195,000 would be required to produce the 350 units.The corporate required rate of return is 18% of assets and the existing asset base in Division A is $2,500,000.Required:

The capacity of the plant is 2,500 units per year.Division B has offered to purchase 350 units from Division A at a price of $1,600/unit, which is the market price of the component.The manager of Division A has refused this offer stating that it would only return a rate of 25.00%, when the divisional target return on sales is 28.00%.The Division A manager also states that additional fixed costs of $195,000 would be required to produce the 350 units.The corporate required rate of return is 18% of assets and the existing asset base in Division A is $2,500,000.Required:

a.How many units must Division A sell in order to achieve its required ROR? What profit margin would be earned at this level of sales?

b.Assume Division A currently sells 2,000 units to the external market and can accept Division B's offer without affecting its external sales.Evaluate the refusal of Division B's offer from the standpoint of the corporation as a whole and from Division A manager's perspective.

c.Assume Division A currently sells 2,000 units to the external market and can accept Division B's offer without affecting its external sales.Calculate Division A's residual income with and without the sale to Division B.

d.What recommendations would you give to the President of Alpine Ltd.with respect to performance evaluation of the divisions?

Definitions:

Hypertension

A health issue distinguished by continuously elevated levels of blood pressure.

Overweight

A state where an individual carries excess body fat that is not considered healthy, typically identified by a Body Mass Index (BMI) ranging from 25 to 29.9.

Pulse Rate

The number of heartbeats per minute, indicating heart rate and cardiovascular health.

Blood Pressure

The force exerted by circulating blood on the walls of blood vessels, a critical indicator of cardiovascular health.

Q17: Hill Manufacturing uses departmental cost driver rates

Q28: Products transferred between subunits within an organization

Q52: Manufacturing firms have three types of inventory:

Q86: A job costing system assigns costs to

Q89: Alsation Ltd.has two divisions:.The Machining Division prepares

Q106: A local engineering firm is bidding on

Q109: Explain what transfer prices are, and what

Q122: What is the return on investment for

Q149: What disadvantage is there in using ROI

Q163: An interactive control system is a formal