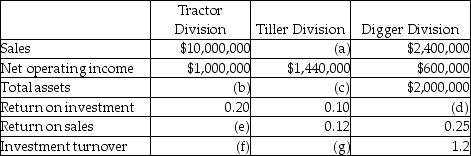

Use the information below to answer the following question(s) .The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records.The main computer system was also severely damaged.The following information was salvaged:

-What is the value of the total assets belonging to the Tiller Division?

Definitions:

Foreign Income Taxes

Taxes paid to a foreign government for income earned in the foreign country.

Child Tax Credit

A credit aimed at helping families offset some of the costs of raising children by reducing their tax liability.

AGI

Adjusted Gross Income, calculated as gross income minus specific adjustments, used to determine tax liability and eligibility for certain tax benefits.

Adoption Credit

A tax credit offered to adoptive parents to offset the costs of adoption, available under the U.S. tax code.

Q30: Easton Ltd.is considering investing in a new

Q31: What is the operating income assuming actual

Q56: Windpower Systems Maintenance Ltd.purchased a CCA Class

Q63: Widget Company sells widgets for $20.00 each.The

Q68: The Micro Division of Silicon Computers produces

Q83: Which of the following is NOT a

Q91: A company is considering purchasing two different

Q97: Aunt Ethel's Fancy Cookie Company manufactures and

Q99: What is the break-even point, assuming the

Q157: Traditional cost systems can be used to<br>A)reveal