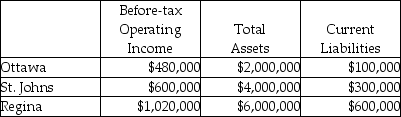

Use the information below to answer the following question(s) .Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million) .The cost of equity capital is 5 percent, while the tax rate is 30 percent.Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for Ottawa?

Definitions:

Payroll Activities

The administrative tasks associated with processing employee wages, withholding taxes, and ensuring the accurate calculation of pay.

Payroll Tax

Taxes that are imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their staff.

FICA Taxes

Taxes mandated by the Federal Insurance Contributions Act, which fund Social Security and Medicare, split between employers and employees.

Federal Income Taxes

Charges imposed by the national government on the yearly income of persons, businesses, trusts, and other legal bodies.

Q8: Why does the Manufacturing Overhead Control account

Q14: The general guideline for setting a minimum

Q17: Hill Manufacturing uses departmental cost driver rates

Q75: In a company with low operating leverage<br>A)fixed

Q82: How much of the account verification cost

Q127: The key to applying CVP analysis in

Q130: Which of the following are not considered

Q135: Cost systems with an exclusive period-by-period focus

Q155: How are cost drivers selected in activity-based

Q156: The payback method measures the time required