Answer the following question(s) using the information below:

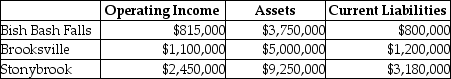

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million) .Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities.The cost of equity capital is 15%, while the tax rate is 30%.

-Novella Ltd.reported a return on investment of 16%, an asset turnover of 6, and income of $190,000.On the basis of this information, the company's invested capital was

Definitions:

Preferred Stock

An ownership type in a corporation that prioritizes claims on assets and income over ordinary shares, often characterized by consistent dividend payouts.

Expected Return

The anticipated return on an investment, accounting for various outcomes and their probabilities.

Cumulative Voting

A voting system that allows shareholders to allocate their total votes in any manner they choose among the candidates running for a position.

Minority Representation

The inclusion and representation of individuals from smaller or less dominant groups within a larger population, often in governance, organizations, or research.

Q12: What is the Edmonton Division's return on

Q25: A local financial consulting firm employs 30

Q25: Discuss some of the recent legislation and

Q29: How many units would have to be

Q54: Expected monetary value may be defined as<br>A)the

Q66: What is the accrual accounting rate of

Q115: The difference between actual costing and normal

Q146: Under distress pricing conditions, long run average

Q155: Post-investment audits<br>A)should be done as soon as

Q161: An increase in the tax rate will