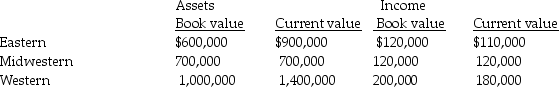

National Can Company has three divisions, Eastern, Midwestern, and Western.Because of very different accounting methods and inflation rates in different countries it is considering multiple evaluation measures.Information gathered about the divisions for the year just ended follows:

The company is currently using a required rate of return of 15 percent.Required:

The company is currently using a required rate of return of 15 percent.Required:

a.Compute the ROI using both book value and current value for all divisions.Round to three decimal places.

b.Compute residual income using book value and current value for all divisions.

c.Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

Definitions:

Cash Cow

A business, product, or asset that consistently generates significant amounts of cash flow, often requiring little investment to maintain.

High Market Share

A situation where a company or product has a higher percentage of total sales revenue of a market compared to its competitors.

Low-Growth Market

A market characterized by slow increases in demand or sales over time.

Heavy Resource Investments

The allocation of a significant amount of organizational resources, such as time, money, and effort, into a project or initiative.

Q19: International Financial Reporting Standards (IFRS)require an annual

Q24: What is the journal entry Beckworth Company

Q34: To calculate the break-even point in a

Q45: A well-designed management control system obtains all

Q46: The timing of feedback depends on the

Q79: The accrual accounting rate of return is

Q132: The Coffee Division of Canadian Products is

Q139: A local attorney employs ten full-time professionals.The

Q140: What is the Alpha Division's return on

Q142: The most popular approach to incorporating the