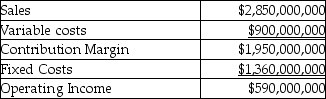

Clark Industries Ltd.manufactures monochromators that are used in a variety of applications.The Monochromator Division (M Division)sells its monochromators both internally and externally.It is operating at 80% of its 250,000 unit capacity and internal sales account for approximately 20% of its current sales volume.Internally the monochromators are transferred into the Aerospace Division (A Division)at a transfer price of $11,250 each.Variable production costs are the same for internal and external sales.The income statement for the M Division is presented below:

The A Division uses one component in the production of its final product that sells for $75,000/unit.Other variable costs in the A Division are 40% of sales.and fixed costs per unit at its current capacity of 40,000 units are $17,250.The Aerospace Division is operating at its full capacity of 40,000 units and is evaluating whether it should invest to increase capacity.The investment would cost $900,000,000 and would have a useful life of 3 years.The equipment could be sold for $800,000 at the end of its useful life.For tax purposes it would be sold on January 1 of year 4.The machine would be used to manufacture a variation of its current product with the same transfer price.This new product would sell for $68,000 per unit.The variable cost ratio will be 45% of the selling price.The additional capacity of the new machine would be 14,000 units.It would qualify for a 30% CCA rate and the company would continue to have assets in the pool.Required:

The A Division uses one component in the production of its final product that sells for $75,000/unit.Other variable costs in the A Division are 40% of sales.and fixed costs per unit at its current capacity of 40,000 units are $17,250.The Aerospace Division is operating at its full capacity of 40,000 units and is evaluating whether it should invest to increase capacity.The investment would cost $900,000,000 and would have a useful life of 3 years.The equipment could be sold for $800,000 at the end of its useful life.For tax purposes it would be sold on January 1 of year 4.The machine would be used to manufacture a variation of its current product with the same transfer price.This new product would sell for $68,000 per unit.The variable cost ratio will be 45% of the selling price.The additional capacity of the new machine would be 14,000 units.It would qualify for a 30% CCA rate and the company would continue to have assets in the pool.Required:

a.Evaluate the current transfer pricing policy from the standpoint of each division manager as well as the company as a whole.

b.Using net present value (NPV)analysis, would the A Division manager want to invest in the new equipment if the required rate of return is 12% and the tax rate is 25%?

c.If the investment is evaluated from a corporate perspective using NPV analysis and the 12% discount rate, does the decision change? Explain.

Definitions:

Medicare

A federal health insurance program in the United States for people aged 65 and older, and for some younger people with disabilities.

Federal Income Tax

A tax by the U.S. federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Net Pay

The amount of money an employee receives after all deductions, such as taxes and retirement contributions, are subtracted from their gross pay.

Federal Unemployment Tax

A tax levied by the federal government on employers to fund state workforce agencies and unemployment insurance programs.

Q22: How many deliveries will Wood Furniture Company

Q23: Cost analysis has two dimensions, which are<br>A)financial

Q82: The simplest version of the economic order

Q84: Sandra's Sheet Metal Company has two divisions.The

Q89: Consolidated Gas Supply Corporation uses the investment

Q97: Companies implementing just-in-time production systems manage inventories

Q104: What would his break-even point be assuming

Q136: A control system that focuses on meeting

Q144: There is seldom a single transfer price

Q174: Find the required amounts, assuming each is