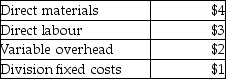

Answer the following question(s) using the information below.Beta Shoe Ltd.manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $20.(Ignore changes in inventory.) The per unit fixed costs are based on a production of 60,000 pairs of shoes.Sole's costs per pair of soles are:

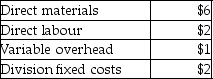

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

-Assume the transfer price for a pair of soles is 180% of total costs of the Sole Division and 40,000 of soles are produced and transferred to the Assembly Division.The Sole Division's operating income is

Definitions:

Homestead Act

A United States federal law passed in 1862 that granted 160 acres of public land to any individual who would farm it for at least five years.

Railroads

A transportation system consisting of a track of rails on which trains travel, used for moving passengers and goods over long distances efficiently.

Dawes Act

A law passed in 1887 that aimed to assimilate Native Americans into US society by allotting individual land parcels to heads of families, stripping away communal tribal land.

Indian Poverty

The state of economic deprivation and lack of access to resources faced by many in India, due to factors such as population density, corruption, and historical inequities.

Q76: Hogan Corporation applies overhead based upon machine-hours.Budgeted

Q81: salaries of frozen food personnel at Gregory

Q84: Which of the following statements is TRUE?<br>A)The

Q96: A corporation has a required rate of

Q108: Camden Company gathered the following information for

Q119: Which of the following are necessary assumptions

Q159: Which of the following is an advantage

Q163: The disposal of a machine (or any

Q175: Identify capital expenditures relevant to accomplishing strategic

Q184: A rental company replaces its heavy drilling