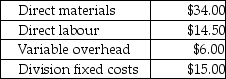

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

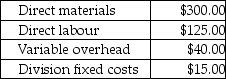

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-If the Assembly Division sells 1,000 air conditioners at a price of $750.00 per air conditioner to customers, what is the company's operating income?

Definitions:

Employment Insurance

A government program that provides financial assistance to eligible workers who lose their jobs and are actively looking for employment.

Portability Clauses

Provisions in contracts or agreements that allow benefits or rights to be transferred from one context to another, such as from one job to another.

Vacation Entitlement

The amount of paid leave time an employee is eligible for, based on the terms of their employment.

Defined Benefit Plans

A type of pension scheme where the benefits that an employee will receive upon retirement are predetermined based on factors like salary history and duration of employment.

Q5: Department A charges Department B $1,350 for

Q23: Janets's Custom Golf sells special clubs.Janet is

Q50: Instead of proration, a company could choose

Q107: The Income Tax Act classifies every amortizable

Q117: List the assumptions required to identify relevant

Q120: The consequences of capital expenditures are<br>A)quantitative and

Q135: Cost systems with an exclusive period-by-period focus

Q136: What is the unit cost for the

Q161: Most Canadian and U.S.companies use the Sarbanes-Oxley

Q167: What are the variable costs per unit