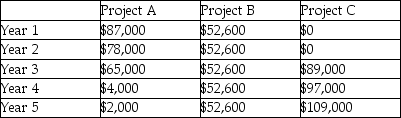

Hiroshi Inc.is evaluating 3 investment alternatives.Each alternative requires an initial investment cash outflow of $176,000 and is to be depreciated on a straight-line basis ($6,000 salvage value).Ignore income taxes.Cash flows for the various investments are summarized below:

The company has a required rate of return of 11.2%

The company has a required rate of return of 11.2%

Required:

a.rank each alternative based on NPV

b.rank each alternative based on IRR

c.rank each alternative based on accrual accounting rate of return using average annual cash flows

d.evaluate each project based on the payback periods

Definitions:

Recognition

The act of acknowledging or identifying something as valid or as having a particular status.

Advancement

The process of moving forward in one's career, which may involve a higher position, increased responsibilities, or better salary.

Job Satisfaction

The level of contentment or happiness an individual feels regarding their job, influenced by factors like work environment, responsibilities, and compensation.

Company Policy

Formal guidelines and rules established by a business to dictate decisions and achieve rational outcomes.

Q3: When considering the net cash inflows resulting

Q19: What costs would be associated with normal

Q27: What are the fixed costs per unit

Q70: Retail Outlet is looking for a new

Q73: After-tax savings from an operating cash inflow

Q94: In situations where the required rate of

Q100: What is Frazer's cost of goods sold?<br>A)$520,000<br>B)$464,000<br>C)$440,000<br>D)$400,000<br>E)$516,000

Q134: Managers use _ to create an ongoing

Q141: Intelligent Composite Materials Inc.is a manufacturer of

Q153: What are Wheels's and Assembly's return on