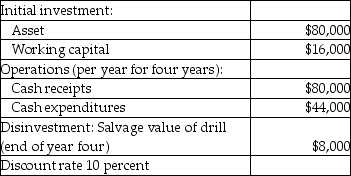

Use the information below to answer the following question(s) .Wet Water Company drills residential and commercial wells.The company is in the process of analyzing the purchase of a new drill.Information on the proposal is provided below:

Note: Other than the initial investment, cash flows are end of period.The working capital is returned at the end of the investment period.

Note: Other than the initial investment, cash flows are end of period.The working capital is returned at the end of the investment period.

-Saturn Ltd.wants to automate one of its production processes.The new equipment will cost $180,000.In addition, Saturn will incur installation and testing costs of $5,000 and $8,500 respectively.The expected life of the equipment is 8 years and the salvage value of the equipment is estimated at $18,000.The annual cash savings are estimated at $32,000.The company's required rate of return is 14%.Ignore income taxes.What is the net present value of this investment?

Definitions:

Payoffs

The outcomes or returns of a decision or action, often expressed in terms of profit or loss.

Risky Undertaking

An action or venture involving a high degree of uncertainty and potential for loss or failure.

Net Profit

The amount of money that remains from revenues after all expenses, taxes, and costs have been subtracted.

Expected Returns

The mean of all the likely returns for an investment or portfolio over a given period, accounting for the risk of those returns.

Q44: A company has two divisions.The Bottle Division

Q46: Purchasing at the EOQ recommended level, what

Q49: Return on sales is calculated by dividing

Q51: Fisher Ltd.is considering the purchase of new

Q80: salary of a real estate agent at

Q105: Cast Iron Stove Company wants to buy

Q112: Manufacturing sector firms normally hold three types

Q149: What would be the monthly operating advantage

Q159: You are the new controller at Ralston

Q162: Factors affecting direct/indirect cost classification include all