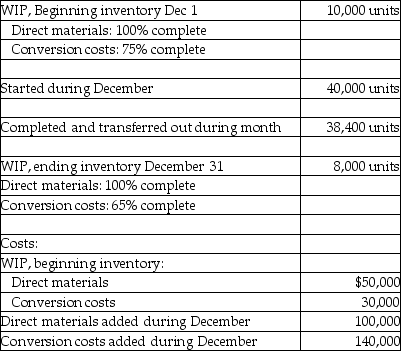

Use the information below to answer the following question(s) .Craft Concept manufactures small tables in its Processing Department.Direct materials are added at the initiation of the production cycle and must be bundled in single kits for each unit.Conversion costs are incurred evenly throughout the production cycle.Before inspection, some units are spoiled due to non-detectable materials defects.Inspection occurs at the end of the process.Spoiled units generally constitute 5 percent of the good units.Data for December are as follows:

-What are the amounts of direct materials and conversion costs assigned to ending work-in-process using the weighted-average process costing method?

Definitions:

Bonds Payable

A long-term debt instrument issued by a company to investors, representing the amount it is obligated to pay back with interest.

Fair Value

A market-based measurement that reflects the amount for which an asset could be exchanged or a liability settled between knowledgeable, willing parties.

Pre-Tax Profit

The profit earned by a business before any tax is deducted.

Intercompany Sales

Transactions of goods or services between divisions or subsidiaries within the same parent company.

Q15: Which of the following statements is TRUE

Q17: Which of the following assertions is TRUE

Q19: For a manufacturing company, direct material costs

Q48: Factors affecting direct/indirect cost classifications are the

Q58: What is the Zorro Company sales-quantity variance?<br>A)$1,500

Q60: Using the stand-alone method with selling price

Q95: Classifying a cost as either direct or

Q114: Broth from cooking food

Q145: Tornado Electronics manufactures CD players.All processing is

Q156: What method is used when joint costs