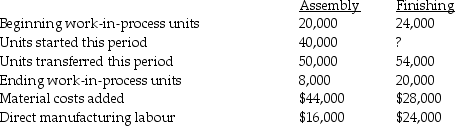

Weather Instruments assembles products from component parts.It has two departments that process all products.During January the beginning work-in-process in the assembly department was half completed as to conversion and complete as to direct materials.The beginning inventory included $12,000 for materials and $4,000 for conversion costs.Overhead is applied at the rate of 50 percent of direct manufacturing labour costs.Ending work-in-process inventory in the assembly department was 40 percent complete.All spoilage is considered normal and is detected at the end of the process.Beginning work-in-process in the finishing department was 75 percent complete as to conversion and ending work-in-process was 25 percent converted.Direct materials are added at the end of the process.Beginning inventories included $16,000 for transferred-in costs and $20,000 for conversion costs.Overhead in this department is equal to direct manufacturing labour costs.Additional information about the two departments follows:

Required:

Required:

Prepare a production cost worksheet using weighted-average for the assembly department and FIFO for the finishing department assuming that spoilage is recognized.

Definitions:

Lower of Cost or Market

An accounting principle that values inventory at the lesser of its historical cost or current market value, used to ensure assets are not overstated.

Inventory Value

The monetary value of all the goods that a company has in stock, not yet sold.

Total Inventory

The complete value of a company's raw materials, work-in-progress, and finished goods at a given time.

Perpetual Inventory System

A system for tracking inventory accounting that instantly logs each sale or acquisition of inventory through computerized point-of-sale systems and software for managing enterprise assets.

Q6: Which of the following journal entries properly

Q6: List three reasons why we allocate joint

Q6: Boone Hospital wants to determine, to the

Q11: What is the conversion cost per equivalent

Q19: To more accurately assess customer profitability, corporate-sustaining

Q25: The first-in, first-out process-costing method assumes that

Q92: Competition places an increased emphasis on cost

Q113: Bag Company had a beginning inventory of

Q114: Calculate this year's operating income if the

Q151: What is the total sales-mix variance in