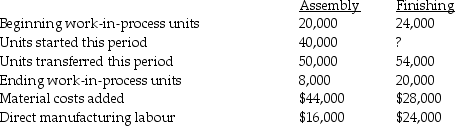

Weather Instruments assembles products from component parts.It has two departments that process all products.During January the beginning work-in-process in the assembly department was half completed as to conversion and complete as to direct materials.The beginning inventory included $12,000 for materials and $4,000 for conversion costs.Overhead is applied at the rate of 50 percent of direct manufacturing labour costs.Ending work-in-process inventory in the assembly department was 40 percent complete.All spoilage is considered normal and is detected at the end of the process.Beginning work-in-process in the finishing department was 75 percent complete as to conversion and ending work-in-process was 25 percent converted.Direct materials are added at the end of the process.Beginning inventories included $16,000 for transferred-in costs and $20,000 for conversion costs.Overhead in this department is equal to direct manufacturing labour costs.Additional information about the two departments follows:

Required:

Required:

Prepare a production cost worksheet using weighted-average for the assembly department and FIFO for the finishing department assuming that spoilage is recognized.

Definitions:

Side

A term that can refer to a location relative to body orientation, an aspect of a situation, or a part of an object opposite another part.

Medicaid

A government-funded program in the United States that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities.

Lead Toxicity Screening

A medical test or series of tests used to determine the level of lead in the blood, important for detecting lead poisoning.

CDC

An abbreviation for Centers for Disease Control and Prevention, a national public health institute in the United States.

Q57: Which of the following journal entries records

Q62: What is the amount of Payton's ending

Q71: What is the total sales-quantity variance in

Q82: What are the normal and abnormal spoilage

Q100: What is Frazer's cost of goods sold?<br>A)$520,000<br>B)$464,000<br>C)$440,000<br>D)$400,000<br>E)$516,000

Q101: What is the amount of direct materials

Q116: Deducting the disposal value from the costs

Q133: A cost object is anything for which

Q135: purchase of frozen food for sale to

Q171: What are the period costs per unit