Answer the following questions using the information below:

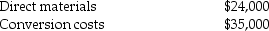

The Rest-a-Lot chair company manufacturers a standard recliner.During February, the firm's Assembly Department started production of 75,000 chairs.During the month, the firm completed 80,000 chairs, and transferred them to the Finishing Department.The firm ended the month with 10,000 chairs in ending inventory.There were 15,000 chairs in beginning inventory.All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process.The FIFO method of process costing is used by Rest-a-Lot.Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.Beginning inventory:

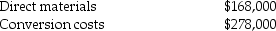

Manufacturing costs added during the accounting period:

Manufacturing costs added during the accounting period:

-What is the Rest-a-Lot company amount of direct materials cost assigned to ending work-in-process inventory at the end of February?

Definitions:

Exchange Rates

The rate at which one currency can be exchanged for another, influenced by market conditions, economic factors, and government policies.

Fluctuations

Variations or changes in value or level, often seen in financial markets, exchange rates, or pricing of commodities.

Income Recognition

The accounting principle that determines the specific conditions under which income becomes recognized as revenue on the financial statements.

Put Option

A financial derivative that gives the holder the right but not the obligation to sell a specified amount of an underlying asset at a predetermined price within a specified time frame.

Q6: When assigning costs, job-costing systems generally distinguish

Q26: What is the Waldorf Computer Systems Inc.direct

Q30: What is the average manufacturing cost per

Q47: How many deliveries will be required at

Q83: The measures used to compute market size

Q85: Under the stand-alone method, which weights better

Q91: What is the amount of gross margin?<br>A)$1,475,000<br>B)$1,500,000<br>C)$1,047,250<br>D)$1,032,500<br>E)$1,007,425

Q132: The production method of accounting for byproducts

Q143: Normal spoilage rates for a manufacturing process

Q149: What is the approximate cost assigned to