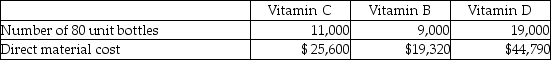

Vita-Heath Company manufactures three different types of vitamins: vitamin C, vitamin B, and vitamin D.The company uses four operations to manufacture the vitamins: mixing, tabletting, encapsulating, and bottling.Vitamins C and B are produced in tablet form (in the tabletting department)and vitamin D is produced in capsule form (in the encapsulating department).Each bottle contains 80 vitamins, regardless of the product.Conversion costs are applied based on the number of bottles in the tabletting and encapsulating departments.Conversion costs are applied based on direct labour hours in the mixing department.It takes two minutes to mix ingredients for a 80-unit bottle for each product.Conversion costs are applied based on machine hours in the bottling department.It takes one-tenth of a minute of machine time to fill a 80-unit bottle, regardless of product.Vita-Health Company uses operation costing.The company is planning to complete one batch of each type of vitamin in March.The budgeted number of bottles and expected direct material cost for each type of vitamin is as follows:

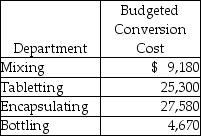

The budgeted conversion costs for March are as follows:

The budgeted conversion costs for March are as follows:

Required:

Required:

1.Calculate the conversion cost rates for each department.2.Calculate the budgeted cost of goods manufactured for vitamin C, vitamin B, and vitamin D for the month of March.3.Calculate the cost per 80-unit bottle for each type of vitamin for the month of July.

Definitions:

Coupon Rate

Yearly interest earnings from a bond, shown as a percentage of its face value.

Par Value

A nominal value assigned to a share of stock as indicated in the corporate charter, not necessarily reflecting its market value.

Yield

The income return on an investment, such as the interest or dividends received, expressed annually as a percentage based on the investment's cost, its current market value, or its face value.

Quoted Price

The last price at which a security or commodity traded, often used as a reference to gauge market value.

Q13: The EOQ quantity for Sandrington is:<br>A)418 units<br>B)506

Q51: Using the sales value at splitoff method,

Q63: Customer specific costs are costs that<br>A)are traceable

Q71: When there is an inconsistency between the

Q88: The Leather Factory has two departments that

Q111: The cost of units completed can differ

Q119: Cost of processing water into different sized

Q151: The possibility of a conflict between the

Q161: If Garry's Golf Supplies makes an order

Q174: Assuming that that fixed and variable costs