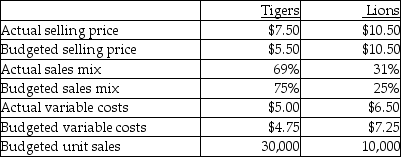

Use the information below to answer the following question(s) .Teddy Bear Company sold a total of 30,000 stuffed tigers and lions.During August the following information was gathered:

-A company sells three different types of satellite dishes in Ontario, but sells only (type 1) in Alberta.Available data are that the budgeted sales mix percentage in Ontario is .35 (type 1) , and .25 (type 2) .The contribution margins per unit are $200 (1) , $120 (2) , and $140(3) .Required: Calculate the budgeted contribution margin per composite unit for the budgeted mix for Ontario and Alberta respectively.

Definitions:

American Put

A type of put option that can be exercised at any time before its expiration, offering the seller protection against declining asset values.

European Put

A type of put option that grants the holder the right, but not the obligation, to sell a specific amount of an underlying asset at a predetermined price on the option's expiration date.

Return Merchandise

The process of returning goods to a vendor or manufacturer due to defects, dissatisfaction, or other reasons.

American Put Option

A financial derivative that gives the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a predetermined price before the option's expiration.

Q9: Costs in beginning inventory are pooled with

Q39: Robotoys Incorporated manufactures and distributes small robotic

Q69: The incremental revenue-allocation method uses product specific

Q77: An advantage of the sales value at

Q82: Customer profitability analysis is used by companies

Q102: Salt from a salt works process

Q122: Which of the journal entries properly records

Q140: Using the NRV method, the amount of

Q155: The cost of visiting customers is an

Q156: The fixed costs of operating the maintenance