Use the information below to answer the following question(s) .Raynor Manufacturing purchases trees from Tree Nursery and processes them up to the splitoff point, where two products (paper and pencil casings) are obtained.The products are then sold to an independent company that markets and distributes them to retail outlets.The following information was collected for the month of October.Trees processed:

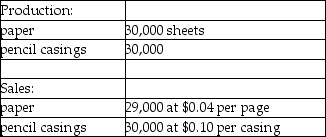

50 trees (yield is 30,000 sheets of paper and 30,000 pencil casings and no scrap)

Cost of purchasing 50 trees and processing them up to the splitoff point to yield 30,000 sheets of paper and 30,000 pencil casings is $1,500.Raynor Manufacturing's accounting department reported no beginning inventories; however, ending inventory amounts reflected 1,000 sheets of paper in stock.

Cost of purchasing 50 trees and processing them up to the splitoff point to yield 30,000 sheets of paper and 30,000 pencil casings is $1,500.Raynor Manufacturing's accounting department reported no beginning inventories; however, ending inventory amounts reflected 1,000 sheets of paper in stock.

-What are the approximate joint costs assigned to the paper ending inventory if joint costs are allocated using the sales value at splitoff method?

Definitions:

Direct Labor Hour

The amount of time spent by workers directly on the manufacturing of products or services.

Direct Labor

The expenses associated with the salaries of workers directly engaged in manufacturing products or providing services.

Job Order Costing

A cost accounting system in which costs are assigned to specific jobs or batches, typical in companies that produce unique products or jobs.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to products based on a relevant driver.

Q1: A favorable market-size variance results with a

Q16: Singh Manufacturing Ltd.manufactures electrical parts.Data for two

Q16: To discourage unnecessary use of a support

Q39: A company sells two products: radios and

Q40: Equivalent units in beginning work in process

Q65: Relevant pricing information for the short-run and

Q76: What is the Capping Department's total cost

Q89: Which of the following can be used

Q137: How can a company account for scrap?

Q139: Sweet Sugar Company processes sugar beets into