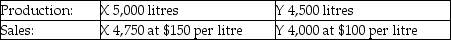

Use the information below to answer the following question(s) .Chem Manufacturing Company processes direct materials up to the splitoff point, where two products (X and Y) are obtained and sold.The following information was collected for the month of November.Direct materials processed:

10,000 litres (10,000 litres yield 9,500 litres of good product and 500 litres of shrinkage)

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

-The Arvid Corporation manufactures widgets, gizmos, and turnbols from a joint process.May production is 4,000 widgets; 7,000 gizmos; and 8,000 turnbols.Respective per unit selling prices at splitoff are $15, $10, and $5.Joint costs up to the splitoff point are $75,000.If joint costs are allocated based upon the sales value at splitoff, what amount of joint costs will be allocated to the widgets?

Definitions:

College Tuition

The fee that institutions of higher education charge for enrollment and instruction.

Forgone Income

Potential earnings not received by choosing one alternative over another, often considered in opportunity cost calculations.

Tuition

The fee charged by educational institutions for instruction and training, typically assessed per term or per course.

Cost of Housing

The total expenses associated with acquiring and living in a home, including purchase price, rent, maintenance, and utilities.

Q5: Manufacturing cycle efficiency is a potential measure

Q18: What are separable costs?

Q38: Assigning joint costs when only a portion

Q39: Robotoys Incorporated manufactures and distributes small robotic

Q47: Under the FIFO method, all spoilage costs

Q58: In each of the following industries, identify

Q89: List and describe the five steps in

Q92: Using the sales value at splitoff method,

Q108: An organization that is using the product

Q149: What is the approximate cost assigned to