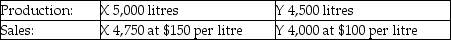

Use the information below to answer the following question(s) .Chem Manufacturing Company processes direct materials up to the splitoff point, where two products (X and Y) are obtained and sold.The following information was collected for the month of November.Direct materials processed:

10,000 litres (10,000 litres yield 9,500 litres of good product and 500 litres of shrinkage)

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

-Product X is sold for $8 a unit and Product Y is sold for $12 a unit.Each product can also be sold at the splitoff point.Product X can be sold for $5 and Product Y for $4.Joint costs for the two products totaled $4,000 for January for 600 units of X and 500 units of Y.What are the respective joint costs assigned to each unit of products X and Y if the sales value at splitoff method is used?

Definitions:

Carrying Amount

The balance of the bonds payable account (face amount of the bonds) less any unamortized discount or plus any unamortized premium.

Unamortized Discount

The portion of a bond's face value that has not yet been expensed as interest over time to reflect the bond being issued below its par value.

Redeemed

The act of paying off or buying back something, such as repaying a bond or exchanging a coupon for goods.

Gain On Redemption

The financial benefit gained when a debt instrument, such as a bond, is redeemed before its maturity at a value higher than its book value.

Q1: One of the purposes of allocating indirect

Q8: Santos Corporation processes a single material into

Q21: What is the number of abnormal spoiled

Q34: If the stand-alone method were used, what

Q73: Muskoka Travel offers guided tours through the

Q76: The sales-volume variance plus or minus the

Q95: Which cost allocation method differentiates between variable

Q107: Transferred-in costs incurred in a previous department

Q113: Complete the following table by recording the

Q175: Which of the following methods of allocating