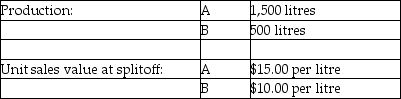

Use the information below to answer the following question(s) .Beverage Drink Company processes direct materials up to the splitoff point, where two products, A and B, are obtained.The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

-What are the expected final sales values of production if Product Z5 and Product W3 are produced?

Definitions:

Intramuscular Injections

A method of delivering medication deep into the muscles, allowing for faster absorption than subcutaneous injections.

Needles

Sharp, pointed instruments attached to syringes for the purpose of piercing the skin to inject substances into the body or extract fluids.

Recapped

The act of covering a needle with a cap or putting a cap back on a container to prevent contamination or exposure.

Injectable Medication

Drugs that are administered through a needle or syringe directly into the body tissue, bloodstream, or muscles.

Q26: Software For You encounters revenue allocation decisions

Q27: The weighted average method of process costing

Q29: What is the total amount debited to

Q39: The constant gross margin percentage NRV method

Q57: Calculate the allocation of packaged price for

Q72: What is the cost of the support

Q96: Campaign Printing has two service departments, S1

Q121: An organization that is using the cost

Q121: Assume the amount of scrap is material

Q122: The controller and sales manager are at