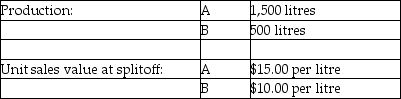

Use the information below to answer the following question(s) .Beverage Drink Company processes direct materials up to the splitoff point, where two products, A and B, are obtained.The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

-Which of the following methods allocates joint costs according to the appraised final sales value in the ordinary course of business less the appraised separable costs of production and marketing?

Definitions:

Occipital Lobe

The region of the brain located at the back of the head, responsible for visual processing.

Arbor Vitae

The branching, tree-like structure of white matter in the cerebellum, which helps in coordinating movement and maintaining balance.

Cerebellum

A major structure of the hindbrain that is involved in motor control, coordination, precision, and accurate timing of movements.

Medulla Oblongata

An extension of the spinal cord into the skull, it orchestrates critical autonomic functions, including respiration and circulation.

Q38: In the weighted-average costing method, the costs

Q49: What is the change in operating income

Q53: Production costs are divided into three classifications:

Q63: _ translates an organization's mission and strategy

Q71: Can a company identify unused capacity and,

Q112: The Laramie Factory produces expensive boots.It has

Q125: The strategy in which companies systematically evaluate

Q127: _ measures the changes in operating income

Q141: Intelligent Composite Materials Inc.is a manufacturer of

Q151: If a dual-rate cost allocation method is