Answer the following question(s) using the information below:

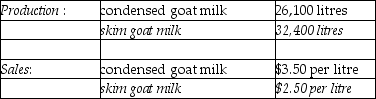

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result.The following information was collected for the month of October:

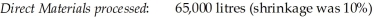

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

-What is the estimated net realizable value of Xyla at the splitoff point?

Definitions:

Self-Actualization

The process by which an individual realizes their own abilities and strives to achieve their full potential.

Humanism

A philosophical and ethical stance that emphasizes the value and agency of human beings, individually and collectively.

Cognitive Perspective

A psychological approach that emphasizes mental processes such as perception, memory, and problem-solving.

Evolutionary Psychology

A theoretical approach in the social and natural sciences that examines psychological structure from a modern evolutionary perspective.

Q21: What is product Y's approximate joint production

Q34: Boxwood Ltd.is reviewing two of its customers

Q64: What is the Rest-a-Lot company cost of

Q113: Complete the following table by recording the

Q117: Purple Paper Company processes wood pulp into

Q127: If the market-size variance is $400 U

Q129: The sales-quantity variance can be unfavourable if

Q134: Learning and growth perspective identifies the capabilities

Q155: The cost of visiting customers is an

Q156: What method is used when joint costs