Use the information below to answer the following question(s) .Raynor Manufacturing purchases trees from Tree Nursery and processes them up to the splitoff point, where two products (paper and pencil casings) are obtained.The products are then sold to an independent company that markets and distributes them to retail outlets.The following information was collected for the month of October.Trees processed:

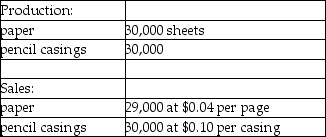

50 trees (yield is 30,000 sheets of paper and 30,000 pencil casings and no scrap)

Cost of purchasing 50 trees and processing them up to the splitoff point to yield 30,000 sheets of paper and 30,000 pencil casings is $1,500.Raynor Manufacturing's accounting department reported no beginning inventories; however, ending inventory amounts reflected 1,000 sheets of paper in stock.

Cost of purchasing 50 trees and processing them up to the splitoff point to yield 30,000 sheets of paper and 30,000 pencil casings is $1,500.Raynor Manufacturing's accounting department reported no beginning inventories; however, ending inventory amounts reflected 1,000 sheets of paper in stock.

-What is the paper's production approximate cost per unit if the sales value at splitoff method is used?

Definitions:

Static Budget

A budget based on a set level of activity and does not change in response to changes in business activity levels during the budget period.

Overhead Costs

Indirect costs incurred in the production process or in the provision of services that cannot be directly tied to a specific product or service.

Overhead Allocation

The process of distributing indirect costs to cost objects such as products, services, or business units.

Variable Overhead

Costs that vary indirectly with production volume, such as utilities or indirect materials.

Q29: In deciding whether to accept a special

Q40: A byproduct has a minimal sales value.

Q67: Under standard costing, there is no need

Q88: Successful implementation of a product differentiation strategy

Q107: Transferred-in costs incurred in a previous department

Q116: If one of four distribution channels is

Q126: Comment on why marketing managers generally find

Q126: To evaluate the success of its strategy,

Q133: There are no logical reasons for allocating

Q142: Cedar Rapids Chemical placed 220,000 liters of