Answer the following question(s) using the information below:

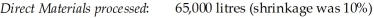

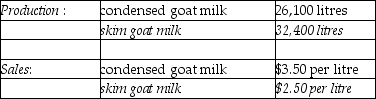

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result.The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

-Using the sales value at splitoff method, what is the gross margin percentage for skim goat milk at the splitoff point?

Definitions:

Attitudes and Behaviors

The relationship between individuals' mental stances or feelings toward something and their actions.

Implicit and Explicit Attitudes

Implicit attitudes are subconscious beliefs or feelings, while explicit attitudes are consciously held beliefs or opinions.

Evaluation of Information

The process of critically analyzing and assessing data or facts to determine their validity, relevance, and reliability.

Automatic System

A mental process that operates without conscious effort, often responsible for habits and intuitive reactions.

Q19: What costs would be associated with normal

Q34: To achieve a cost leadership strategy companies

Q37: What is the market-share variance?<br>A)$360,000 U<br>B)$1,260,000 F<br>C)$1,152,000

Q46: Which of the following linear equations would

Q70: Which of the following is an assumption

Q88: What is the complete reciprocated cost of

Q126: Comment on why marketing managers generally find

Q147: Using the direct method, what amount of

Q164: Two entities, Burch Company and Carey Company,

Q181: What is the reason that accountants do