Use the information below to answer the following questions:

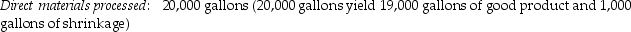

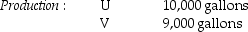

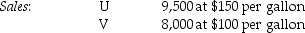

Argon Manufacturing Company processes direct materials up to the splitoff point where two products (U and V) are obtained and sold.The following information was collected for last quarter of the calendar year:

The cost of purchasing 20,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 19,000 gallons of good products was $1,950,000.Beginning inventories totaled 100 gallons for U and 50 gallons for V.Ending inventory amounts reflected 600 gallons of Product U and 1,050 gallons of Product V.October costs per unit were the same as November.

The cost of purchasing 20,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 19,000 gallons of good products was $1,950,000.Beginning inventories totaled 100 gallons for U and 50 gallons for V.Ending inventory amounts reflected 600 gallons of Product U and 1,050 gallons of Product V.October costs per unit were the same as November.

-What is the joint cost allocation to product U using the sales value at splitoff method?

Definitions:

Feature Articles

In-depth written pieces that explore a topic, person, or event in detail, often providing background, analysis, and personal perspectives.

Naming Rights

The commercial right to name a venue, event, or product, often for advertising benefits and brand recognition.

Athletic Venues

Facilities designed for hosting sports events and physical activities, including stadiums, arenas, and gymnasiums.

PR Professional

An individual specializing in public relations, responsible for managing and improving the public image and relationships of clients or employers.

Q14: Which of the following journal entries properly

Q16: Which of the following is false concerning

Q17: What is the number of normal spoiled

Q49: If a single-rate cost allocation method is

Q93: The sales-mix variance is calculated using the

Q96: Campaign Printing has two service departments, S1

Q96: Uncertainty refers to the possibility that an

Q120: Standard costing can be used in process

Q123: Required:<br>a.What is the operating income for Year

Q143: Caulfield Ltd.has two production departments in the