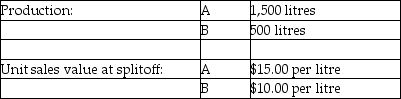

Use the information below to answer the following question(s) .Beverage Drink Company processes direct materials up to the splitoff point, where two products, A and B, are obtained.The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

-What are the expected final sales values of production if Product Z5 and Product W3 are produced?

Definitions:

Federal Unemployment Tax Rate

The rate at which employers are taxed by the federal government to fund the unemployment benefit programs.

Current Liabilities

Current Liabilities are a company's debts or obligations that are due to be paid within one year and are listed on the company’s balance sheet. They typically include accounts payable, short-term loans, and other accrued liabilities.

Principal Repaid

The amount of loan or debt's original borrowing that has been or is being paid back, excluding interest payments.

Long-Term Notes

Debt securities or loans with maturities extending beyond one year, typically used for long-term financing needs.

Q7: Strategies have been classified in many different

Q9: The single-rate cost allocation method provides better

Q19: The incremental common cost allocation method requires

Q45: One of the important aspects about the

Q82: It is possible to design a hybrid

Q93: What is the Luke Company's revenue effect

Q103: When there are insignificant amounts of beginning

Q120: Which of the following journal entries could

Q126: How many units were started and completed

Q159: Using the step-down method, what amount of