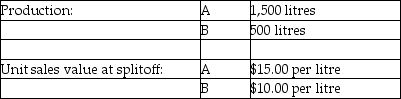

Use the information below to answer the following question(s) .Beverage Drink Company processes direct materials up to the splitoff point, where two products, A and B, are obtained.The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

-What is Product Z5's estimated net realizable value?

Definitions:

Behavioural Approach

A method that focuses on studying observable and measurable behaviors rather than internal mental states.

Self-Actualizing

The process of realizing and fulfilling one's own potential and capabilities, often referred to as the pinnacle of psychological development in Maslow's hierarchy of needs.

Group Pressures

Different forms of influence that a group may exert on individual members to conform to certain behaviors or beliefs.

Scalar Chain Principle

A concept in organizational theory that suggests a clear line of authority from the top management to the lowest ranks.

Q31: Which of the following departments is least

Q34: Boxwood Ltd.is reviewing two of its customers

Q49: Separable costs include manufacturing costs only.

Q58: In each of the following industries, identify

Q71: When choosing between using budgeted rates, and

Q81: Why would a manager perform customer-profitability analysis?

Q125: The accounting (for a bakery)entry to record

Q154: Revenue allocation is required to determine the

Q165: The manager of the Finishing Department is

Q171: The sales value at splitoff method can