Answer the following question(s) using the information below:

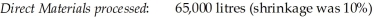

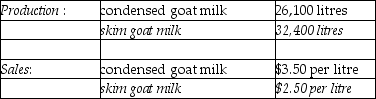

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result.The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

-What is the estimated net realizable value of Xyla at the splitoff point?

Definitions:

Spread

A statistical term describing the range, distance, or variance between data points in a dataset, indicating the variability within the data.

Scatter

In data visualization, a plot that displays the relationship between two or more variables by using dots to represent values.

Central Location

A term used to describe an area that is strategically situated within a city or region, often easily accessible from various points.

Histogram

A graphical display of data using bars of different heights to show the frequency distribution of a dataset.

Q4: Metal Cabinet Company manufactures two and four

Q11: An activity-based costing system may focus on

Q15: If a dual-rate cost allocation method is

Q32: What is the target operating income?<br>A)$240,000<br>B)$360,000<br>C)$200,000<br>D)$192,000<br>E)$400,000

Q32: The market-share variance is caused solely by

Q78: The Organic Milk Company produces three products

Q81: A company can alter its total gross

Q104: To discourage excessive use of a support

Q157: What is the target cost?<br>A)$800,000<br>B)$960,000<br>C)$1,440,000<br>D)$1,600,000<br>E)$768,000

Q161: Which of the following could be described